All Categories

Featured

Table of Contents

- – Best-In-Class Accredited Investor High Return ...

- – Advanced Venture Capital For Accredited Invest...

- – Dependable Accredited Investor Secured Invest...

- – Venture Capital For Accredited Investors

- – Expert-Driven Accredited Investor Financial ...

- – Most Affordable Passive Income For Accredite...

- – Accredited Investor Investment Funds

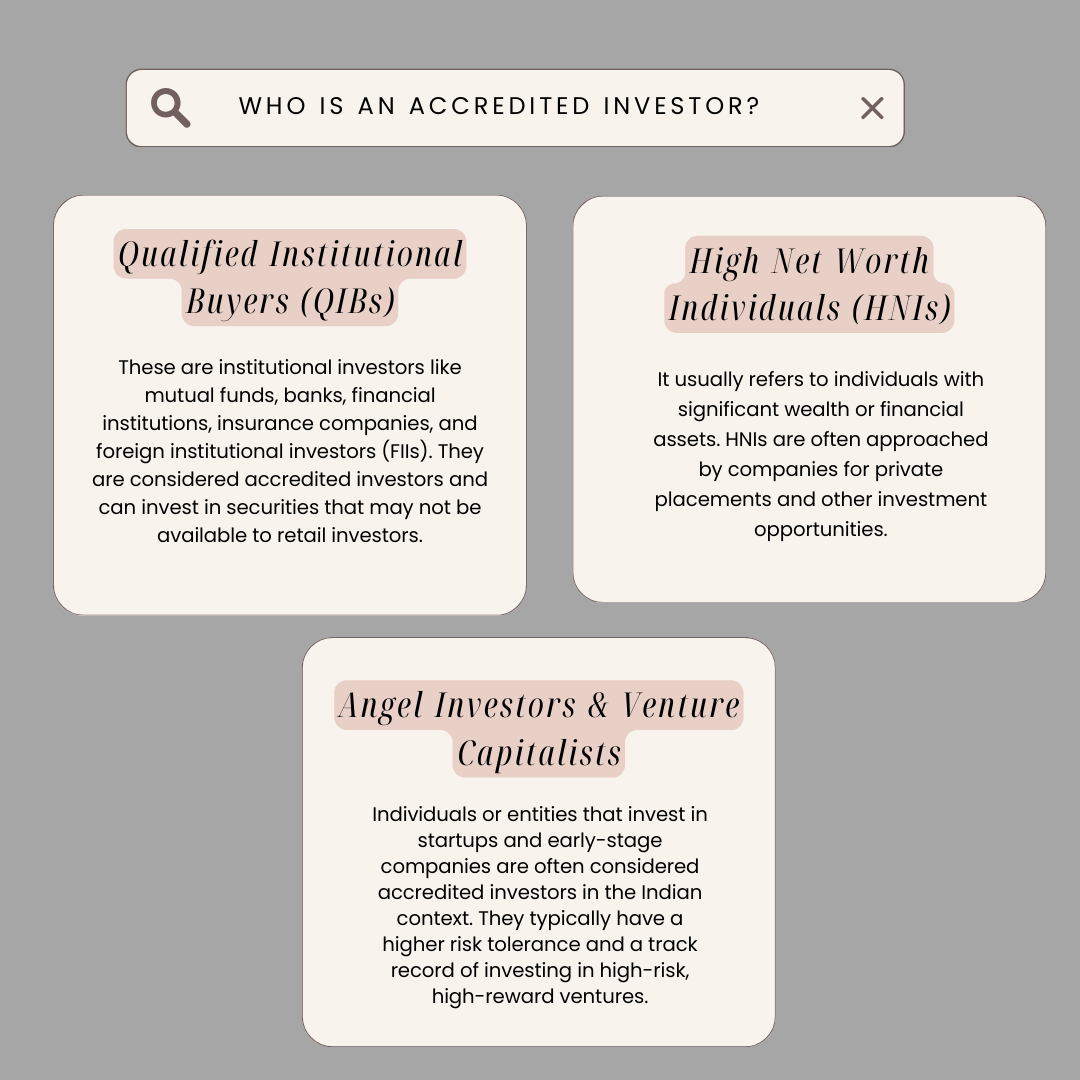

The laws for accredited financiers differ among territories. In the U.S, the interpretation of a certified capitalist is presented by the SEC in Rule 501 of Law D. To be an accredited capitalist, an individual must have an annual income exceeding $200,000 ($300,000 for joint revenue) for the last 2 years with the assumption of earning the exact same or a higher income in the existing year.

This amount can not consist of a primary home., executive police officers, or supervisors of a firm that is providing unregistered safety and securities.

Best-In-Class Accredited Investor High Return Investments

If an entity consists of equity owners that are accredited financiers, the entity itself is an accredited investor. An organization can not be formed with the sole function of buying specific protections. An individual can certify as an accredited capitalist by demonstrating enough education or work experience in the economic sector

People who want to be certified financiers do not put on the SEC for the classification. Instead, it is the responsibility of the business using an exclusive positioning to make certain that all of those come close to are certified financiers. People or celebrations who wish to be accredited capitalists can come close to the provider of the unregistered safety and securities.

As an example, suppose there is a private whose earnings was $150,000 for the last 3 years. They reported a main residence worth of $1 million (with a mortgage of $200,000), an automobile worth $100,000 (with an exceptional finance of $50,000), a 401(k) account with $500,000, and a savings account with $450,000.

This person's net well worth is exactly $1 million. Given that they meet the internet worth requirement, they certify to be a recognized financier.

Advanced Venture Capital For Accredited Investors with Growth-Focused Strategies

There are a couple of much less usual certifications, such as handling a count on with more than $5 million in properties. Under government securities legislations, just those who are certified financiers may take part in certain protections offerings. These may include shares in private positionings, structured products, and private equity or hedge funds, to name a few.

The regulatory authorities intend to be certain that individuals in these highly high-risk and complex investments can look after themselves and evaluate the risks in the lack of government security. The recognized investor guidelines are designed to protect potential capitalists with minimal financial expertise from adventures and losses they might be ill outfitted to hold up against.

Accredited investors fulfill certifications and expert criteria to gain access to unique financial investment possibilities. Designated by the U.S. Stocks and Exchange Payment (SEC), they gain access to high-return options such as hedge funds, equity capital, and exclusive equity. These investments bypass full SEC enrollment but carry higher dangers. Certified capitalists must fulfill income and internet worth requirements, unlike non-accredited people, and can invest without constraints.

Dependable Accredited Investor Secured Investment Opportunities

Some vital modifications made in 2020 by the SEC include:. This change acknowledges that these entity kinds are often used for making financial investments.

These changes increase the accredited financier pool by about 64 million Americans. This wider gain access to gives more opportunities for investors, however additionally boosts potential threats as less financially innovative, capitalists can get involved.

One major benefit is the chance to invest in placements and hedge funds. These financial investment options are unique to accredited investors and establishments that qualify as a certified, per SEC guidelines. Private placements allow business to protect funds without navigating the IPO procedure and regulatory documents needed for offerings. This offers certified financiers the possibility to spend in emerging business at a stage before they think about going public.

Venture Capital For Accredited Investors

They are viewed as investments and are available just, to certified clients. Along with known business, qualified investors can pick to invest in startups and promising endeavors. This offers them income tax return and the opportunity to enter at an earlier phase and possibly gain rewards if the firm succeeds.

Nonetheless, for investors available to the risks included, backing start-ups can result in gains. Numerous of today's technology companies such as Facebook, Uber and Airbnb stemmed as early-stage start-ups sustained by recognized angel investors. Advanced capitalists have the opportunity to discover investment choices that might produce a lot more profits than what public markets provide

Expert-Driven Accredited Investor Financial Growth Opportunities

Returns are not assured, diversity and portfolio improvement options are broadened for financiers. By diversifying their portfolios through these increased investment opportunities approved capitalists can improve their strategies and potentially achieve superior long-lasting returns with correct risk management. Seasoned investors usually experience investment alternatives that may not be conveniently readily available to the general investor.

Investment alternatives and safety and securities provided to recognized capitalists generally entail greater dangers. As an example, personal equity, financial backing and bush funds frequently focus on buying properties that bring threat however can be liquidated easily for the possibility of higher returns on those dangerous financial investments. Looking into prior to spending is crucial these in situations.

Lock up periods protect against capitalists from withdrawing funds for more months and years on end. There is also far much less transparency and governing oversight of private funds contrasted to public markets. Capitalists may struggle to accurately value private possessions. When handling threats recognized capitalists need to evaluate any kind of personal investments and the fund supervisors involved.

Most Affordable Passive Income For Accredited Investors

This change may extend recognized investor status to a series of people. Updating the earnings and possession standards for rising cost of living to guarantee they show changes as time proceeds. The current limits have remained static given that 1982. Allowing companions in fully commited connections to combine their resources for shared qualification as certified financiers.

Allowing individuals with specific professional certifications, such as Series 7 or CFA, to qualify as accredited capitalists. Creating additional requirements such as proof of monetary literacy or successfully finishing an approved financier exam.

On the other hand, it might additionally lead to skilled investors assuming too much threats that may not be ideal for them. So, safeguards might be needed. Existing accredited financiers might face raised competition for the best investment opportunities if the pool grows. Firms elevating funds may profit from an increased recognized capitalist base to attract from.

Accredited Investor Investment Funds

Those that are currently considered recognized financiers need to stay upgraded on any kind of changes to the requirements and guidelines. Their qualification could be subject to adjustments in the future. To preserve their standing as recognized capitalists under a changed meaning modifications might be essential in riches administration tactics. Businesses seeking accredited investors must remain vigilant about these updates to guarantee they are drawing in the ideal target market of capitalists.

Table of Contents

- – Best-In-Class Accredited Investor High Return ...

- – Advanced Venture Capital For Accredited Invest...

- – Dependable Accredited Investor Secured Invest...

- – Venture Capital For Accredited Investors

- – Expert-Driven Accredited Investor Financial ...

- – Most Affordable Passive Income For Accredite...

- – Accredited Investor Investment Funds

Latest Posts

Unmatched Tax Foreclosure Overages Strategy Best States For Tax Overages

Tax Overages Business

Investor Law

More

Latest Posts

Unmatched Tax Foreclosure Overages Strategy Best States For Tax Overages

Tax Overages Business

Investor Law